Are Asia Marketplaces Destined for Skyrocketing Take Rates Like Amazon in the U.S. and Europe?

Article

Nov 26, 2025

The short answer: yes — the trajectory is very clear, and sellers in Asia should brace for it now.

Marketplaces globally have enjoyed dominant power over third-party sellers. Over time, they’ve been very effective—and aggressive—at “monetizing” their control: raising fees, adding hidden surcharges, and shifting cost burdens onto sellers. What we see in the U.S. and Europe today is not a distant warning: it’s often a blueprint for what’s coming in Asia.

In this article, we walk through Amazon’s evolving “cut” of seller revenue, then draw parallels to Shopee, Lazada, and other Asian marketplaces. We’ll highlight key inflection points, the strategic risks to brands, and why it’s time to “move upstream” into D2C now—before the squeeze really tightens.

The Amazon Playbook: From Referral Fees to 50–60% “Cut”

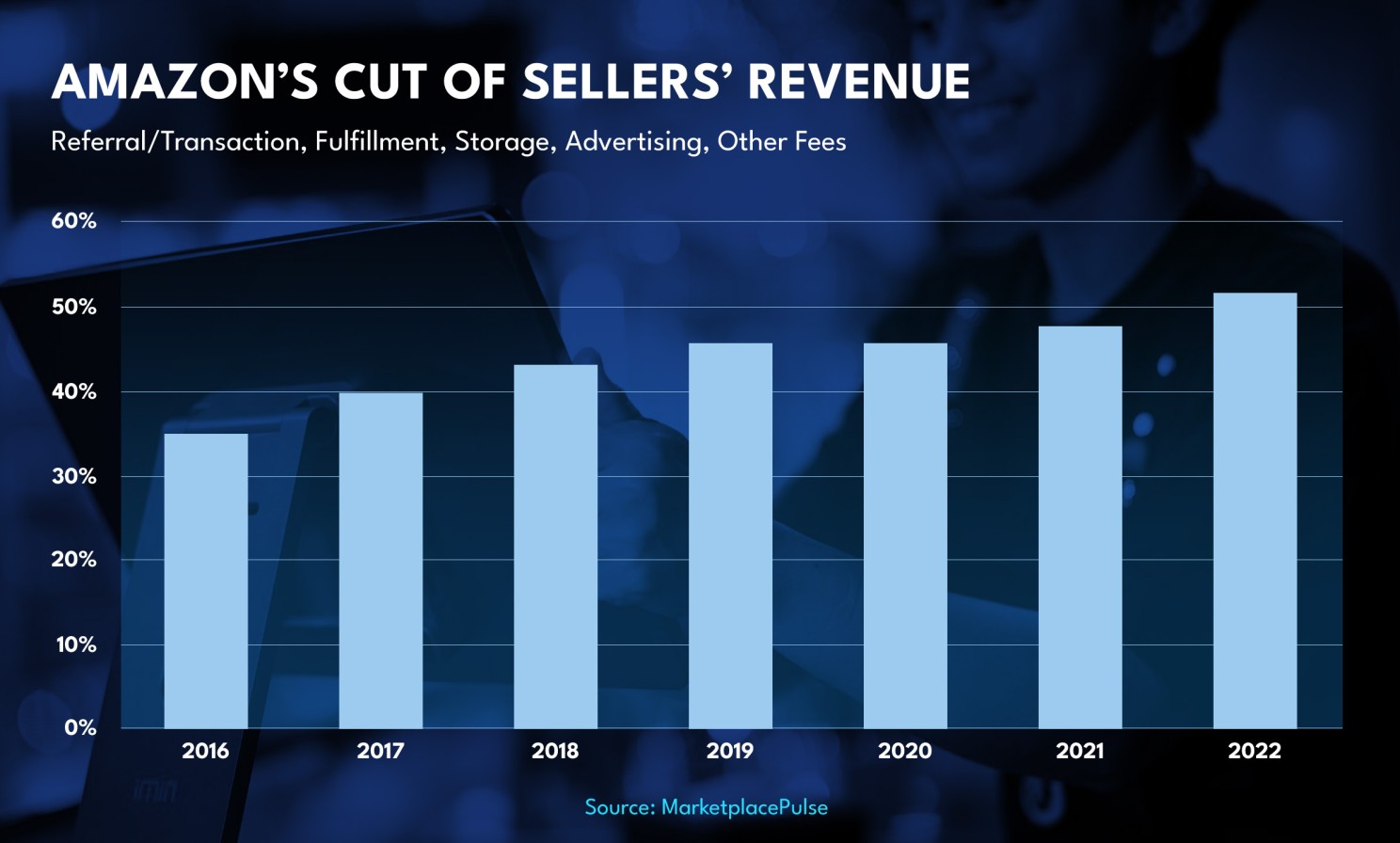

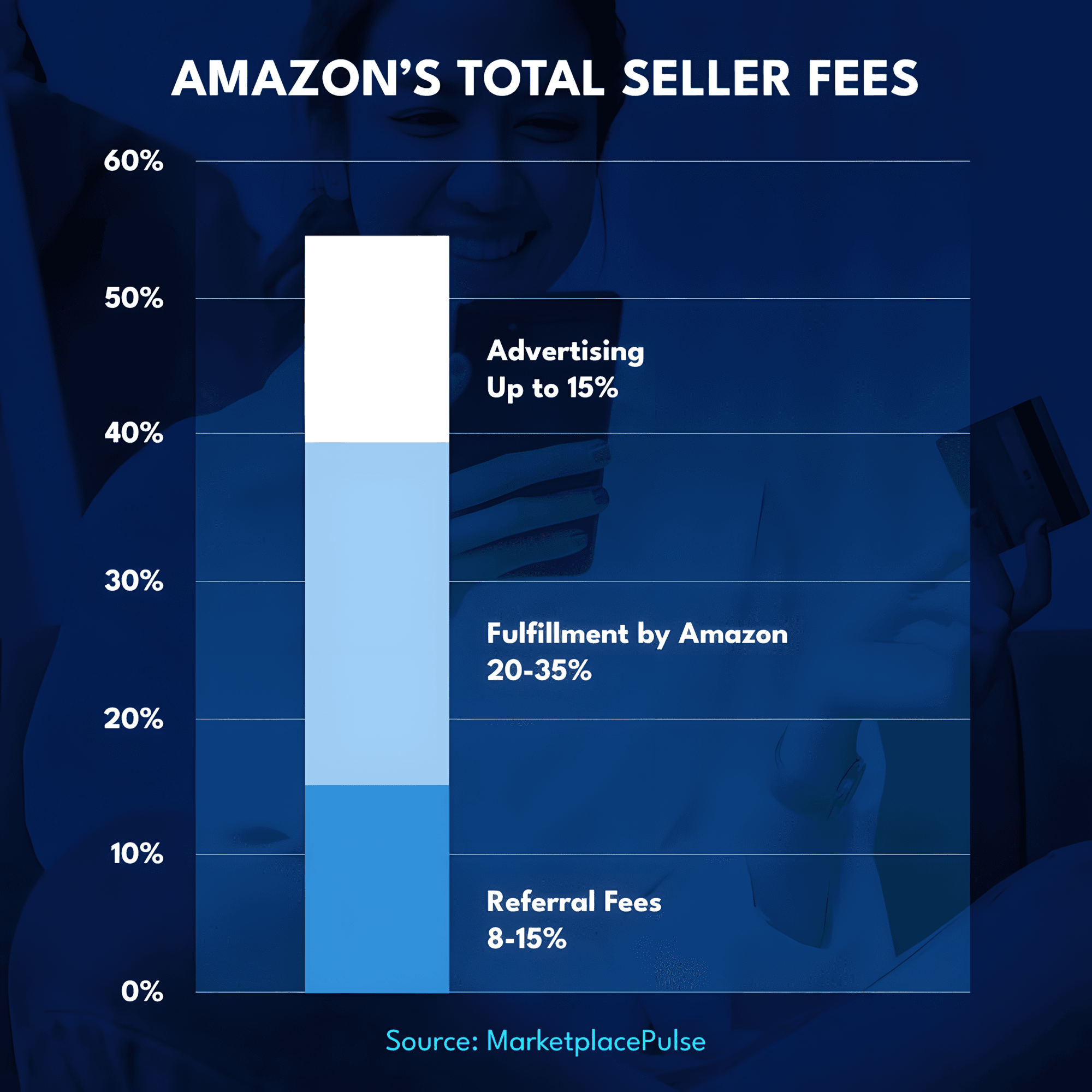

One of the most alarming insights in recent years is how Amazon’s aggregate fees—referral, FBA, storage, advertising, returns, fulfillment, and behavioral fees—have piled up in seller economics.

MarketplacePulse reported that a “typical private-label seller” in the U.S. might pay 50–60% of gross sales across all Amazon-imposed fees. (Marketplace Pulse)

Even if Amazon doesn’t always raise base referral or FBA fees each year, it layers in more “behavioral” or “penalty” fees: low-inventory-level fees, returns processing fees, surcharges, placement fees, etc. (Marketplace Valet)

In 2025, Amazon signaled there would be no broad across-the-board referral / FBA hikes in the U.S., but recent years’ steep increases already shifted the burden. (Marketplace Valet)

In essence: Amazon monetizes control. Since sellers “must” advertise, use FBA (for Prime), maintain inventory, and adhere to performance metrics, the platform effectively locks in sellers—and funnels more revenue streams from them. (Marketplace Pulse)

So Amazon’s “cut” is not just a simple percentage. It’s an ecosystem where each choice (advertising, fulfillment style, inventory strategy) is taxed again and again. Over time, many sellers find their margins under systematic compression.

Asia Marketplaces: The Take Rate Catch-Up

If Amazon is the archetype, Asia marketplaces are following in those footsteps—albeit selectively, market by market.

Shopee: Escalating Take Rates

Shopee has made multiple fee increases over the past year, pivoting from “growth-first” to “monetization-first” in many markets. (Business Times)

Some headline changes:

In Malaysia, the commission for cross-border direct mail sellers rose from 16.2% → 18.36%. (Duoke)

In Singapore, similar upward adjustments pushed commission / platform fees for cross-border orders to ~14%. (Duoke)

In Singapore, local “non-fulfilled by Shopee / mall” sellers reportedly saw commission jump from 5.45% → 7.63% and transaction fees from 2.18% → 3.27%. (Reddit)

In certain markets, Shopee’s total “take-rate” (commission + transaction + other mandatory fees) is creeping into double digits (8–12 % or more) depending on product category. (Cube)

The pattern is deliberate: marketplaces raise baseline commission, then layer transaction fees, advertising “boosts,” fulfillment add-ons, and platform surcharges. Each incremental step looks modest, but cumulatively they erode margins.

Lazada & Others: Behind the Curve (for now)

Lazada, Tokopedia, and other regional marketplaces haven’t moved as aggressively—yet—but they’re watching. When vendors start realigning strategies or defecting to D2C, platform operators often respond. Already, some reports in Southeast Asia have flagged that average platform fees (commission + logistics + platform surcharges) across marketplaces are encroaching toward 20–25% “take” in some scenarios. (LinkedIn)

It’s a ticking explosion: as sellers feel the pinch, some will push back or exit—but many will simply absorb it (by raising prices, cutting service, or shrinking margins).

Correlation & Lessons: Amazon vs Shopee

The trajectory is that Asian marketplaces are fast catching up. The playbook is evident: start with moderate commissions, then gradually layer hidden fees, push mandatory services, and squeeze margin. Amazon has already walked this path; Asia marketplaces are mapping the same route.

Massive Market Change Has Already Begun, and Sellers Aren’t Ready

This is not a distant risk—it’s happening now:

We’re seeing commission hikes in key Shopee markets (Singapore, Malaysia) as platforms recalibrate for profitability. (Duoke)

Sellers in Singapore have already publicly noted platform fee jumps: e.g. commission rising from 5.45% to 7.63%, minimum selling fee rising to ~10.9%. (Reddit)

Rising platform fees coincide with marketplaces pushing new models (boosts/ads, priority placements, logistics programs) that further upcharge sellers. (Business Times)

Amazon, too, is not standing still: while broad referral/FBA hikes may pause, new behavioral fees and penalties are growing in influence. (Marketplace Valet)

The economic environment (inflation, supply chain volatility, tighter investor expectations) is pushing marketplaces to monetize revenue aggressively.

What this means: if sellers continue to rely solely on marketplaces, margins will be squeezed — not by competition, but by platform design.

Why NOW Is the Time to Either Build or Double-Down on Your D2C / Brand Site

“If you don’t feel the pain of D2C setup today, you’ll feel the pain of margin erosion tomorrow. Yes, building a brand website or .com retail channel is harder up front—logistics, traffic, fulfillment—but it’s the only way to escape the marketplace “tax” and regain control over pricing, customer data, and margins.”

– Chris Benz, CEO of Kemana

Here are key arguments:

Control Your Margins On your own site, you decide shipping, promotions, bundling, and discount cushions—not the marketplace.

Own Customer Relationships Marketplaces own the customer interface and data. In D2C, you own email capture, retargeting, loyalty, and product feedback loops.

Flexible Cost Structure You’re no longer forced into mandatory ad/boost programs. You choose your marketing, fulfillment partners, logistics model etc.

Diversification Reduces Risk If a marketplace hikes fees or changes policy, you don’t lose your entire sales channel — D2C cushions the blow.

Easier Scaling & Optimization You can build upsell flows, subscription models, branded content, and personalized experiences not easily done on marketplaces.

Sure — setting up D2C is more work initially: inventory syncing, tech stack, traffic acquisition, fulfillment, returns, conversion optimization. But that work is the investment. If you wait until every marketplace is squeezing margins to zero, the effort and cost to break away become exponentially more difficult.

Risks, Challenges & Realities to Prepare For

Moving to D2C is not a panacea. Some of the challenges:

Traffic / CAC: Marketplace shoppers come with built-in demand. Driving comparable traffic to your own site requires investment and ongoing marketing spend.

Technology & Integration: Inventory sync, payment gateways, fraud, returns, customer service — setting this up properly is nontrivial.

Fulfillment & Logistics: You lose the convenience of marketplace logistics. Building your own or selecting a partner is a strategic decision.

Trust & Conversion: Sellers must build credibility, reviews, and conversion funnels on their own domain.

Operational bandwidth: Running a brand site is operationally heavier — you need to manage more moving parts.

But here’s the catch: the cost of not doing it grows every year. Eventually, you could be trapped in a profitable but margin-starved existence under marketplace rent.

Bottom Line & Call to Action

Amazon’s fee escalation curve is no myth. Sellers in the U.S. and Europe already feel the “platform tax” — often 50–60% of gross. (Marketplace Pulse)

Shopee (and soon Lazada / others) are clearly following a similar path: rising commissions, new surcharges, mandatory advertising, and deeper control over logistics. (Business Times)

The massive market shift is not coming—it’s here. Sellers are already seeing the squeeze.

The time to act is now: build your D2C / brand site in parallel, absorb the learning curve now rather than later.

Embrace the pain today for margin freedom tomorrow.

Source: Kemana Technology

Related News

Article

Jan 13, 2026

Article

Dec 23, 2025

Article

Dec 9, 2025

Article

Nov 19, 2025

Article

Nov 13, 2025

Article

Oct 28, 2025

Article

Oct 16, 2025